Yesterday we found out that the US economy slipped into a technical recession, contracting by -0.9%, during Q2, prompting a discussion as to whether it should be described in such a way given the resilience of the labour market. Putting semantics to one side it is abundantly clear that irrespective of what the data is showing us, in relative terms we are all feeling the effects in our pockets of the global events that are pinching down on consumer incomes.

With that in mind markets have started to price out the prospect of more aggressive action by central banks when it comes to raising rates, pushing yields lower and giving a boost to equity markets. In that context we can expect to see a higher European open, as German 2-year yields hit two month lows. Well received numbers from Amazon and Apple after the bell last night have also helped boost sentiment.

Today’s smorgasbord of economic data, from the UK, EU and the US is set to confirm what we already know and are experiencing in our everyday lives.

Starting with Europe we have Q2 GDP from France, Germany, Italy and the EU and all of it is set to point to a weak quarter of economic activity. On the broad EU basis Q2 GDP is expected to slow to 0.2% from 0.6% in Q1. In Germany we will be lucky to see any expansion at all and given the current geopolitical and economic backdrop this could be as good as it gets for a while.

We also get a quick snapshot of flash CPI for July after the numbers from Germany jumped higher to 8.5% in numbers released yesterday.

This presents an enormous challenge for the ECB having seen the central bank raise rates for the first time since 2011 last week. The 50bps rate rise is unlikely to have a marked effect on how quickly or slowly inflationary pressures will continue to rise across the region. We’ve already seen further sharp rises in European gas prices this week due to reduced gas flows through Nord Stream 1.

With inflation as high as 20% in some parts of the euro area, whether the bank headline rate is at -0.5% or at zero is neither here nor there. Having seen June CPI confirmed at 8.6% only last week, the persistently high readings we’ve been seeing in respect of PPI, which is at over 30% in several parts of the EU, means we probably haven’t seen the peak yet, and we can expect this to move closer to 9%, later this morning.

Higher interest rates are also impacting economic activity in the UK, mortgage approvals have slowed markedly in the last few months, and are expected to slow again in June, from 66.2k to 65k in what would be a two-year low. Net consumer credit for June is expected to remain steady at £1bn.

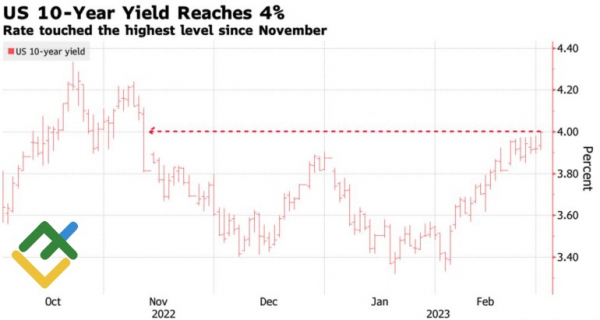

In the afternoon, and in the wake of this week’s decision by the Federal Reserve to hike by another 75bps, and confirmation of the US economy slipping into recession yesterday we’ll be getting the latest personal spending data for June, along with the most recent core PCE inflation data, given that it is the Fed’s preferred measure of inflation targeting.

While headline CPI and PPI for June both saw unexpected increases in the headline numbers, it was notable that on the core numbers, both fell back. That’s been the overall trend for core prices since February and March, however the rise in food and energy prices is starting to create ripple out effects that could call a halt to the recent declines from the current peaks we saw in March.

Core PCE deflator, peaked at 5.3% in February, and has declined every month since then, coming in at 4.7% in May, and is expected to remain steady at these levels in June..

What will the June numbers tell us? Are we nearing a peak, and even if we are, does the Fed even look at its preferred measure of inflation targeting?

For the moment it doesn’t appear that the Fed is that interested, in fact we can’t even be sure what data the US central bank is targeting now they’ve dropped forward guidance. Is it jobs, is it CPI, or is it inflation expectations with the latest University of Michigan numbers out later this afternoon, and the 5-10 year inflation expectations, which dropped to a one year low of 2.8% earlier this month.

EUR/USD – continues to struggle below the peaks of last week at the 1.0275 area. While below the risk remains for a move back towards parity, and the previous lows at 0.9950. A move below 0.9950, towards 0.9660.

GBP/USD – still below the 50-day SMA, and down trend from the February highs at 1.2220 area. Support remains at the 1.1870 area, with the bias remaining towards the downside while below the 50-day SMA.

EUR/GBP – while below the 0.8400 area, momentum remains negative for a move towards the 0.8300 area. We also have resistance back up near the 0.8480 area.

USD/JPY – slid sharply lower yesterday falling towards the 50-day MA. A break below the 50-day MA opens up further losses towards the 131.50 area. Having fallen below the lows this month the bias seems to have shifted with resistance now at 135.50.